Gaming As A Service Market Size & Trends

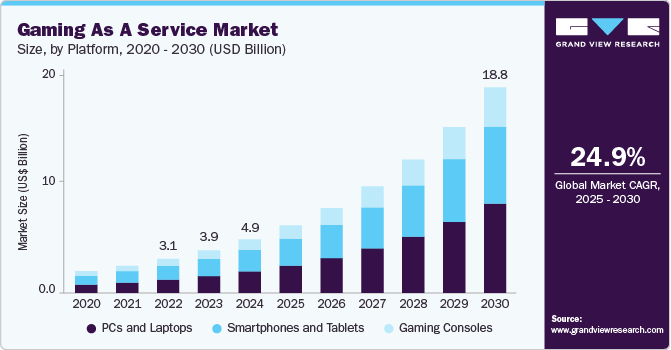

The global gaming as a service market size was estimated at USD 4.91 billion in 2024 and is expected to expand at a CAGR of 24.9% from 2025 to 2030. The rise of cloud gaming is a key driver in gaming as a service (GaaS) market, reshaping how games are accessed and played.

Key Market Highlights:

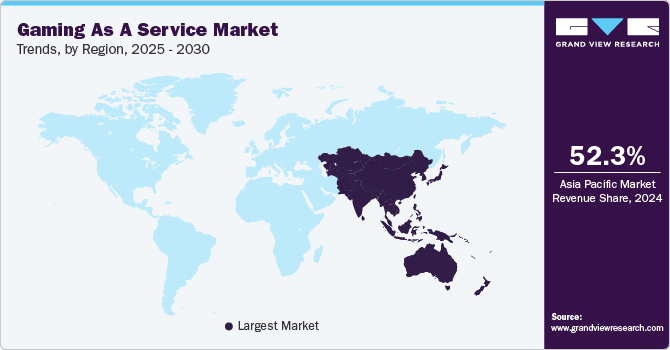

- The gaming as a service market in North America generated a significant revenue share, accounting for 23% in 2024.

- The gaming as a service market in the U.S. held a dominant position in 2024.

- In terms of platform segment, the smartphones and tablets segment captured the highest market share of over 40% in 2024.

- In terms of subscription segment, the subscription segment captured the highest market share in 2024, due to the rising demand for affordable, flexible access to a wide range of games.

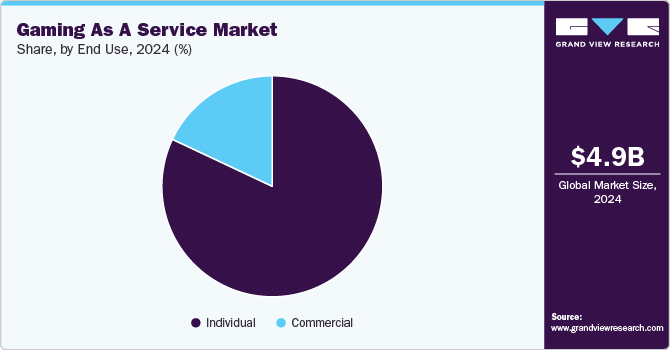

- In terms of subscription segment, the individual segment captured the highest market share in 2024, driven by the increasing reliance on digital platforms and evolving consumer habits.

Advances in cloud infrastructure now enable seamless streaming of graphically intense games, removing the need for high-end hardware and broadening access to a larger audience. Platforms like Google Stadia and NVIDIA GeForce Now are leading this shift by offering instant game access across a range of devices with a stable internet connection.

This growing accessibility and reduced entry barriers accelerate market expansion by enabling players to enjoy AAA games on mobile phones, tablets, and smart TVs. Key drivers such as improvements in internet speed, the rollout of 5G, and advances in edge computing are enhancing streaming quality and minimizing latency. As a result, cloud gaming is becoming a central component of gaming as a service model, offering a consistent, high-quality experience regardless of hardware limitations.

The shift towards free-to-play games, supported by in-game microtransactions, is among the most popular market trends. Many developers are choosing this revenue model to attract a wide audience without the barrier of entry costs. Microtransactions, such as cosmetic items or character skins, are a steady source of income, enabling developers to update games regularly. The success of free-to-play titles like Apex Legends and Call of Duty: Warzone proves this model can create sustainable revenue. Gaming as a service industry continues to embrace microtransactions, driving innovation in in-game purchases and virtual economies.

Esports are becoming an essential part of the market, with exponential growth in tournaments, live streams, and organized competitions. Game developers are incorporating esports elements directly into their games, enhancing the competitive aspect and creating opportunities for professional play. Platforms like Twitch and YouTube Gaming are becoming the go-to spaces for watching esports, amplifying the visibility and reach of games. This integration also benefits developers, as it helps extend their games’ lifecycle through sustained community engagement. The continued growth of esports within the GaaS ecosystem demonstrates the increasing professionalization and commercialization of competitive gaming.

Live service games, which are constantly updated with new content and events, are a prominent trend in the market. Titles like Fortnite and Destiny 2 have embraced this model, offering ongoing updates, seasonal events, and new features that keep players engaged for extended periods. This trend has led to games becoming more like ongoing services rather than one-time purchases, with developers using player feedback to refine the experience. As a result, live service games have become highly profitable by maintaining active player bases and regularly introducing new monetization strategies. Gaming as a service industry is evolving to prioritize long-term player engagement over short-term sales.

Gaming as a service industry in Asia Pacific is experiencing a surge in mobile gaming, driven by the high penetration of smartphones and the increasing availability of affordable mobile data plans. Countries like China, Japan, and South Korea lead the way with a massive gaming audience, and mobile-first game development is at the forefront of innovation. China has witnessed the rise of mobile games such as PUBG Mobile and Honor of Kings, contributing significantly to the region’s gaming revenue. This trend has led to local developers focusing on creating mobile-optimized experiences that cater to regional tastes. As the gaming as a service industry continues to expand, Asia Pacific is poised to be a dominant force, thanks to its mobile gaming leadership and tech-savvy demographic.

Sony has also made significant strides in the gaming-as-a-service industry through its PlayStation Now and PlayStation Plus services. PlayStation Now allows gamers to stream and download a wide range of PlayStation games, making it a competitive player in the cloud gaming space. Sony’s PlayStation Plus service, which offers monthly game downloads and exclusive discounts, further enhances the company’s subscription-based model. With a large and loyal user base, Sony has been integrating more cloud-based features into its ecosystem, providing an all-in-one gaming service. The growth of PlayStation’s subscription services and the upcoming launch of its new PlayStation Plus tiers further solidify Sony’s role as a key player in the evolving gaming-as-a-service industry.

Platform Insights

The smartphones and tablets segment captured the highest market share of over 40% in 2024, driven by rising mobile penetration and on-demand access to high-quality games. With the expansion of 5G networks and edge computing, latency issues are being reduced, enhancing the mobile gaming experience. In addition, the increasing adoption of freemium models and in-game monetization strategies has accelerated user engagement and revenue generation on mobile platforms. Cloud gaming services are now tailored for smartphones and tablets, further democratizing access to premium content without needing high-end hardware. As a result, this segment is expected to dominate the platform landscape by 2030 in terms of user base and revenue contribution.

PCs and laptops is expected to witness the highest CAGR of over 26% from 2025 to 2030. The rising demand for immersive and high-performance gaming experiences is sustaining the segment’s growth. Enthusiast gamers prefer PCs due to their superior processing capabilities, customization options, and compatibility with high-end peripherals. While mobile and console platforms expand, PCs remain a critical hub for esports, modding communities, and competitive online gaming. The segment also sees increasing integration with cloud gaming and subscription services, which offer users access to extensive game libraries without frequent hardware upgrades. However, growth is projected to be slower compared to mobile platforms, as the PC user base is more saturated and less reliant on GaaS for accessibility.

Game Type Insights

The action segment captured the highest market share in 2024. The growing demand for fast-paced, visually rich, and competitive experiences continues to drive the Action segment within the market. This genre remains a top choice for casual and hardcore gamers alike, due to its instant gratification, engaging gameplay mechanics, and compatibility across platforms. Action games are particularly well-suited for episodic content delivery and frequent updates, aligning perfectly with the GaaS model. Moreover, cloud-based platforms enhance accessibility, enabling users to play high-fidelity action titles on devices with minimal hardware requirements. Despite strong performance, the segment’s growth is gradually stabilizing as newer genres like role-playing and adventure gain momentum with evolving player preferences.

The role-playing segment is expected to witness the highest CAGR from 2025 to 2030, driven by players’ increasing desire for immersive, narrative-driven experiences and deeper character development. RPGs have evolved to offer expansive worlds, rich storylines, and player-driven choices, creating long-term engagement opportunities. The rise of cloud gaming and subscription services has expanded access to AAA RPG titles, allowing players to enjoy high-quality experiences without needing expensive hardware. As the demand for customization and social interaction in games grows, RPGs increasingly integrate multiplayer elements, pushing the boundaries of traditional solo gameplay. The segment is expected to continue its upward trajectory, especially as cloud platforms enable easier access to complex RPGs that were previously hardware-intensive.

Revenue Model Insights

The subscription segment captured the highest market share in 2024, due to the rising demand for affordable, flexible access to a wide range of games. As platforms like Xbox Game Pass and PlayStation Now grow in popularity, consumers increasingly prefer the convenience of paying a fixed monthly fee for unlimited access to an extensive library of titles. This model has gained traction with the rise of cloud gaming, allowing players to enjoy high-quality games without expensive hardware. Subscription services also enhance their offerings with exclusive content, early releases, and multi-device accessibility, making them more attractive to users. As the market evolves, subscription-based models are projected to become the dominant revenue source in the GaaS landscape, driven by both consumer preference and the continuous growth of cloud-based gaming.

The in-game purchases segment is expected to witness the highest CAGR from 2025 to 2030, owing to the widespread adoption of freemium models and the increasing reliance on microtransactions. Players are increasingly willing to spend money on cosmetic items, virtual currency, and progression enhancements, which enrich their gaming experience without affecting gameplay balance. As live service games become more prevalent, developers have been able to leverage regular updates, special events, and exclusive content to encourage ongoing spending. However, this segment has faced growing scrutiny from regulators and consumers regarding the ethics of monetization strategies, particularly in games with younger audiences. Despite these concerns, in-game purchases are projected to maintain significant growth as developers refine their monetization approach and enhance player value.

End Use Insights

The individual segment captured the highest market share in 2024, driven by the increasing reliance on digital platforms and evolving consumer habits. As gaming becomes a mainstream form of entertainment, individuals seek more convenient and cost-effective ways to access their favorite titles, leading to the widespread adoption of cloud gaming and subscription services. With many gamers preferring the flexibility of playing across multiple devices, the shift toward cross-platform gaming has made it easier for individuals to stay engaged. Moreover, the growth of social features, such as multiplayer modes and in-game chat, has further increased the appeal of gaming to individual users who value interaction and community-building. This segment is expected to remain dominant, with individual players continuing to fuel the demand for both freemium models and premium content.

The commercial segment is expected to witness the highest CAGR from 2025 to 2030. The growing demand for gaming as a service among businesses and organizations has fueled market expansion. Businesses, such as gaming cafes, eSports arenas, and corporate training programs, are increasingly adopting GaaS to provide entertainment and engagement for their customers, employees, or clients. Furthermore, the rise of gamification in enterprise applications is driving the demand for more sophisticated and interactive gaming solutions, which are integrated into business strategies for training, team-building, and customer engagement. eSports sponsorships and tournaments have further bolstered this segment, with companies leveraging gaming as a tool for brand visibility and audience engagement. As a result, the commercial segment is expected to grow rapidly, with businesses seeking to capitalize on the vast reach and revenue potential of gaming.

Regional Insights

The gaming as a service market in North America generated a significant revenue share, accounting for 23% in 2024. The market continues to grow, fueled by the high adoption of cloud gaming and subscription-based services. The region’s established gaming infrastructure and the widespread availability of high-speed internet enable seamless access to premium games via streaming platforms. This trend is particularly supported by leading companies like Microsoft and Sony, which are significantly expanding their subscription offerings and cloud gaming technologies.

U.S. Gaming as a Service Market Trends

The gaming as a service market in the U.S. held a dominant position in 2024. This market is being driven by an increasing demand for digital content and interactive entertainment. American consumers are increasingly opting for subscription models like Xbox Game Pass and PlayStation Plus, which offer extensive game libraries and regular updates. In addition, the rise of mobile gaming and cloud-based solutions further enhances accessibility, providing a diversified gaming experience across platforms.

Europe Gaming as a Service Market Trends

The gaming as a service market in Europe was identified as a lucrative region in 2024. It is rapidly evolving, with a strong shift toward digital game subscriptions and cloud gaming. The growing adoption of 5G networks is expected to enhance the cloud gaming experience, particularly in countries with advanced mobile infrastructures like Germany and the UK. This development prompts gaming companies to tailor their offerings, ensuring seamless play across different devices, from consoles to mobile phones.

Germany gaming as a service market is seeing increased interest in localized content and subscription services that cater to regional tastes. Germany’s gaming community is highly engaged, with an increasing number of players turning to streaming platforms such as Google Stadia and NVIDIA GeForce Now. Furthermore, the demand for immersive, story-driven content has prompted German developers to collaborate on new cloud-based gaming innovations to meet this growing demand.

The gaming as a service market in the UK benefits from a large, enthusiastic gaming community that increasingly values subscription-based access to content. As the popularity of esports and competitive gaming continues to rise, British players gravitate toward services offering multiplayer access and constant game updates. Furthermore, the UK government’s support for the digital entertainment sector is contributing to the steady growth of the gaming ecosystem in the region.

Asia Pacific Gaming as a Service Market Trends

The gaming as a service market in the Asia Pacific region is expected to grow at the highest CAGR of over 26% from 2025 to 2030. The Asia Pacific market is experiencing rapid growth, particularly in the mobile and cloud gaming segments. With the increasing availability of high-speed internet and mobile networks like 5G, cloud gaming has become a central focus for service providers looking to tap into the region’s large, diverse gaming audience. The rise of local gaming giants in countries such as China and Japan drives the growth of region-specific gaming platforms and subscription models.

China gaming as a service market is expanding due to a surge in mobile gaming and the country’s increasing affinity for cloud-based services. Chinese gaming companies are leading in mobile-first game development, with a growing focus on esports and interactive entertainment. Moreover, government regulations push developers to adapt their business models to incorporate more sustainable, subscription-based offerings that align with changing consumer preferences.

The gaming as a service market in India is gaining momentum, particularly among younger consumers embracing mobile and online gaming. Subscription services and in-game purchases have become more popular as affordable smartphones and improved internet connectivity make gaming more accessible. Local game developers increasingly focus on creating region-specific content to cater to India’s diverse cultural and linguistic preferences.

Middle East & Africa Gaming as a Service Market Trends

The gaming as a service market in the Middle East and Africa is witnessing rapid expansion, driven by increasing disposable income and the younger population’s enthusiasm for gaming. The region is shifting from console gaming to cloud and mobile-based solutions, as these services allow players to access games without expensive hardware. Furthermore, the rise of esports and competitive gaming in countries like Saudi Arabia creates new opportunities for gaming companies to expand their regional offerings.

Saudi Arabia gaming as a service market is flourishing, with a growing number of consumers adopting subscription-based gaming models. The country has become a key player in the esports industry, with large-scale tournaments and investments in gaming infrastructure. In addition, the Saudi government’s Vision 2030 initiative promotes digital entertainment, further bolstering the growth of the gaming industry, including cloud gaming and mobile-based services.

Key Gaming As A Service Company Insights

Some key players operating in the market include Microsoft Corporation and Tencent.

-

Microsoft Corporation is a pioneer in the GaaS space through its Xbox Game Pass and Xbox Cloud Gaming (xCloud) services. It has built a strong subscription-based ecosystem that offers cloud-enabled, cross-platform access to a vast game library. Microsoft emphasizes integration across devices and is increasingly incorporating AI and live-service enhancements into its gaming platform. It specializes in hybrid delivery models, subscription gaming, and multi-device cloud experiences.

-

Tencent operates some of the most profitable GaaS titles globally, such as PUBG Mobile and Honor of Kings. The company heavily invests in live-service mobile and PC titles, with regular updates, monetization layers, and competitive esports frameworks. Tencent also holds a significant stake in Western GaaS leaders like Riot Games and Epic Games. It dominates the mobile-first GaaS model and emphasizes constant content evolution and community engagement.

Riot Games and Valve Corporation are some of the emerging participants in the market.

-

Riot Games has emerged from being a single-title studio to a GaaS powerhouse, expanding beyond League of Legends into Valorant, Teamfight Tactics, and more. All its titles use live-service models with seasons, cosmetics, and strong esports ecosystems. Riot also explores mobile and cross-media experiences like animated series and music to reinforce player engagement. It specializes in multiplayer, competitive live services with rich IP storytelling.

-

Valve Corporation is expanding its live-service model with long-term, evolving games like Dota 2 and Counter-Strike: Global Offensive (CS: GO), continually releasing new content, skins, and seasonal updates. The company has successfully monetized through microtransactions, particularly in esports and community-driven content. Valve also integrates its gaming ecosystem through the Steam platform, enhancing the multiplayer and user-generated content experience. Their trend is focused on maintaining and expanding their community-centric, free-to-play titles while integrating esports and live events.

Key Gaming As A Services Companies:

The following are the leading companies in the GaaS market. These companies collectively hold the largest market share and dictate industry trends.

- Activision Blizzard

- Bandai Namco Entertainment

- Electronic Arts (EA)

- Epic Games

- Microsoft Corporation

- Riot Games

- Sony Interactive Entertainment

- Square Enix

- Take-Two Interactive

- Tencent Games

- Ubisoft

- Valve Corporation

Recent Developments

-

In March 2025, Amazon Web Services (AWS) launched Amazon GameLift Streams, a cloud gaming service that enables developers to stream games directly to devices like smart TVs. Jackbox Games is among the first to utilize this technology, planning to release a beta version of its cloud streaming service on select smart TV platforms in Spring 2025. This initiative aligns gaming as a service model by facilitating easier access to games without consoles or PCs, enhancing player engagement, and expanding monetization opportunities through ad-supported and subscription-based offerings.

-

In January 2025, KRAFTON collaborated with NVIDIA to unveil a Co-Playable Character (CPC) built with NVIDIA ACE at CES 2025. As part of this innovation, KRAFTON showcased a CPC named “PUBG Ally” integrated into the PUBG franchise. This CPC is capable of engaging in real-time conversations, providing situational advice, and adapting to user gameplay using on-device small language models (SLMs). This advancement supports gaming as a service model by enhancing live-service games with AI-driven, personalized experiences that promote continuous player engagement and monetization.

Gaming As A Service Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 6.18 billion

|

|

Revenue forecast in 2030

|

USD 18.82 billion

|

|

Growth rate

|

CAGR of 24.9% from 2025 to 2030

|

|

Base year for estimation

|

2024

|

|

Historical data

|

2018 – 2023

|

|

Forecast period

|

2025 – 2030

|

|

Quantitative units

|

Revenue in USD million/billion and CAGR from 2025 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Technology, range, platform, end use, regional

|

|

Regional scope

|

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

|

|

Country scope

|

U.S.; Canada; Mexico; UK; Germany; France; China; Australia; Japan; India; South Korea; Brazil; Saudi Arabia; UAE; South Africa

|

|

Key companies profiled

|

Microsoft Corporation; Sony Interactive Entertainment; Tencent Games; Activision Blizzard; Electronic Arts (EA); Ubisoft; Epic Games; Valve Corporation; Riot Games; Take-Two Interactive; Square Enix; Bandai Namco Entertainment

|

|

Customization scope

|

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Global Gaming As A Service Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global gaming as a service market report based on platform, game type, revenue model, end use, and region:

-

Platform Outlook (Revenue, USD Million, 2018 – 2030)

-

PCs and Laptops

-

Smartphones and Tablets

-

Gaming Consoles

-

-

Game Type Outlook (Revenue, USD Million, 2018 – 2030)

-

Action

-

Adventure

-

Role-Playing

-

Simulation

-

Strategy

-

Sports

-

Others

-

-

Revenue Model Outlook (Revenue, USD Million, 2018 – 2030)

-

Subscription

-

In-Game Purchases

-

Advertising

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 – 2030)

-

Regional Outlook (Revenue, USD Million, 2018 – 2030)

-

North America

-

Europe

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global gaming as a service market size was estimated at USD 4.91 billion in 2024 and is expected to reach USD 6.18 billion in 2025.

b. The global gaming as a service market is expected to grow at a compound annual growth rate (CAGR) of 24.9% from 2025 to 2030 to reach USD 18.82 billion by 2030

b. Asia Pacific gaming as a service (GaaS) market dominated the market with a share of over 52% in 2024, owing to the rise of local gaming giants in countries such as China and Japan.

b. Some key players operating in the GaaS market include Microsoft Corporation, Sony Interactive Entertainment, Tencent Games, Activision Blizzard, Electronic Arts (EA), Ubisoft, Epic Games, Valve Corporation, Riot Games, Take-Two Interactive, Square Enix, and Bandai Namco Entertainment.

b. The key factors driving the gaming as a service market include the rise of cloud gaming, growing advancements in cloud infrastructure, and enhancements in internet speed, the rollout of 5G, and advances in edge computing.